Financial Awareness

Raising Year 9 financial awareness

On Friday 26 April 2019, all Year 9 pupils were off timetable for 4 lessons to take part in our annual Year 9 Financial Awareness Conference in their tutor groups. The first two sessions were delivered by Deer Park teachers, accompanied by volunteers from St James’s Place Wealth Management, Cirencester, with the latter two sessions run by the SJP staff.

We had a visitor in school on Thursday and Friday, reviewing both the Humanities and RP/GC Faculties, and she and Miss Hope, Head of Humanities, dropped in to a class during Session 1. She was very impressed with the quality of this session and our pupils’ engagement.

Pupils were led through four sessions:

- What is Money Worth?

- Wants vs Needs

- Budgeting

- Understanding Debt.

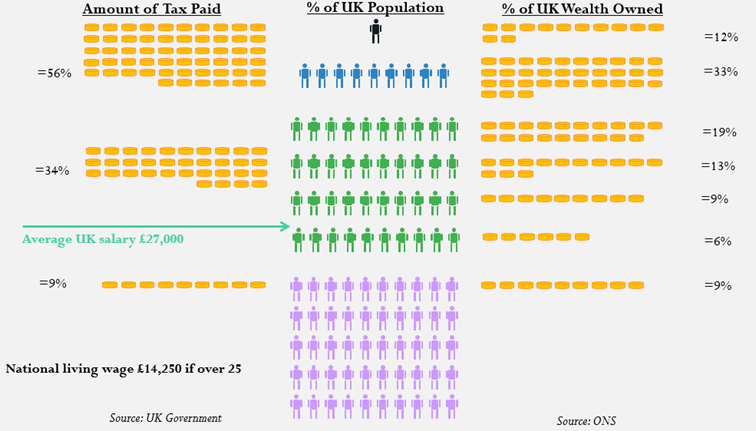

During What is Money Worth? pupils were given the task of working out salaries associated with roles as diverse as A-list actors, teachers and cleaners, and it was fascinating to see their estimates. They then looked at the value of certain roles in society and recognised the important service provided by some of the lowest paid members of society. Our Year 9s looked at the following image and considered the division of wealth in the UK - this stimulated heated discussions.

It is important for us all to understand the distinction between Wants and Needs - although what teenagers consider a 'need' may be considered a 'want' by an adult! In Wants vs Needs our young people began to realise that you need to prioritise needs over wants. A Need is something you have to have, whereas a Want is something you would like to have. It is always interesting to see what Year 9s will first classify as a Need, for example, mobile phone. In reality, to survive you only need enough food and water to maintain your health, a roof over your head (including utilities) and basic clothing. Everything else - branded items, fancy foods and drinks, fast car - is a Want. However, we all aim for more than mere survival, we aim to live and some items feel closer to Needs than Wants. We reinforced how important it is to meet all basic Needs first, and then some of the Wants might also be acquired, when they can be afforded.

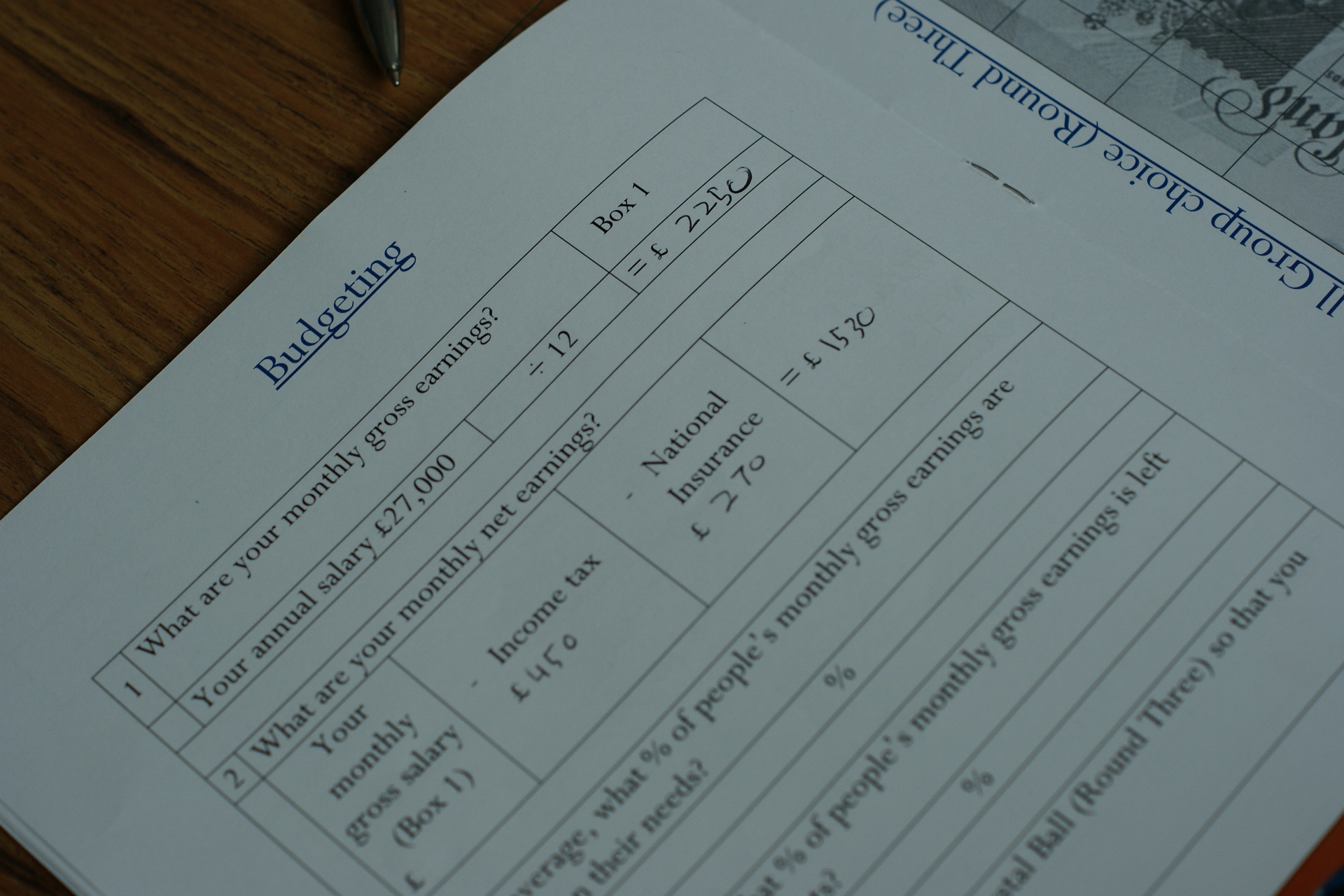

In Budgeting, pupils were each given a family scenario in which they were exposed to the cost of living. They had to calculate the difference between gross and net pay - looking at income tax and national insurance. Taxation was a real shock to the pupils and they were surprised about the amounts that were paid out. Working together in groups, they looked at covering needs and working out what was left for various wants. Everyone has to budget, including the UK Government.

Finally pupils examined the subject of Debt. They were shocked at the difference in interest rates charged by the various lenders. Our Year 9s engaged in a game where they had to guess the type of borrowing without being given key words, similar to the game Taboo. Pupils were made aware of organisations that could help them should they ever find themselves in financial difficulties, for example The Money Advice Service and Citizenship Advice Bureau.

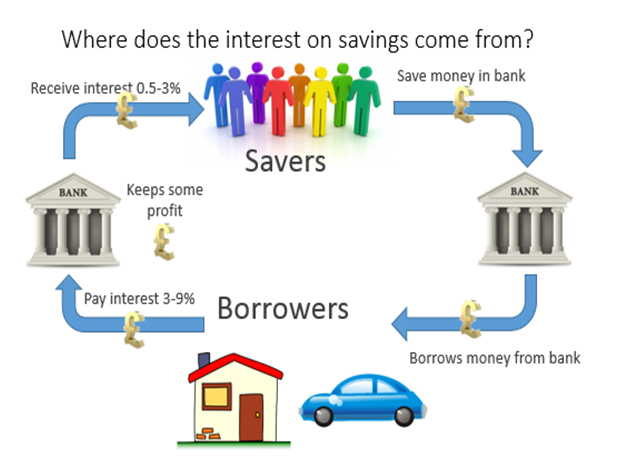

Pupils were able to make links throughout the day to the importance of saving. They discovered how the banks operate with the help of the diagram below:

By comparing the questionnaires that pupils completed at both the start and end of the day, it was clear that after the 4 sessions our Year 9s had a much clear understanding of the world of personal finance and were much more financially aware. Year 9 were a credit to the school, and as a result were awarded Kudos points!

Sarah: "I found it really helpful to understand the different ways that you can borrow money and it extended my knowledge of budgeting. I feel that it will help me in the future."

Alice: "I found the day really interesting and helpful. It allowed me to understand the multiple ways to save up and borrow money as well as budgeting."

Ethan: "It taught me a great deal about growing up in terms of handling money. Although I do not fully understand all the different loans and credit cards that you can take out. It has made me reflect on being an adult and being responsible for my finances. It was a great day and fun."

Useful Links